Tuition Discount Opportunities

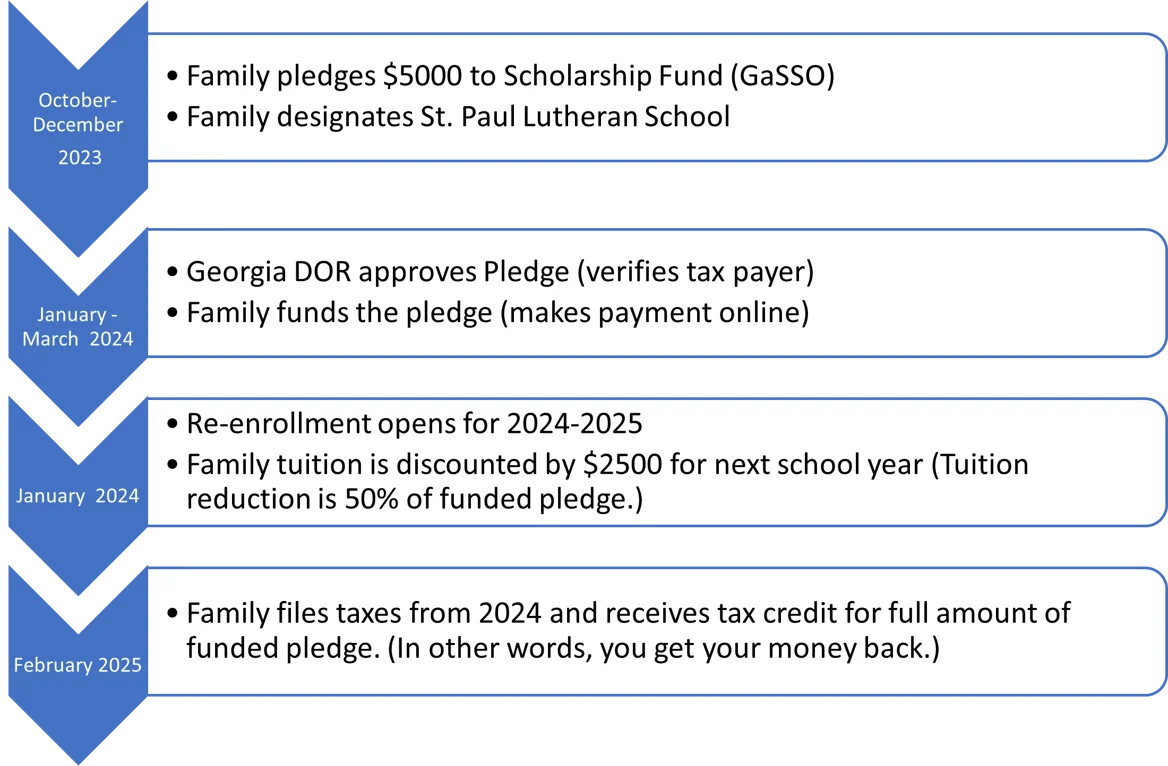

St Paul is making available a tuition discount opportunity for the 2024-2025 school year for participants in the Georgia GaSSO tax credit program that essentially has no cost to you. Here is an outline of the opportunity: 2024-2025 tuition will be discounted by $2500 per family for ever $5000 funded pledge through the Georgia Tax Credit program – your pledge will be credited to your tax return the following year. Full details are found at GeorgiaSSO.com and you can submit your pledge today!

What is a Tax Credit?

Unlike a deduction, a tax credit is applied toward your Georgia state income taxes. In other words, your contribution of $2500 will come off your Georgia income taxes dollar for dollar. Families have up to 5 years to exhaust a tax credit in Georgia.

Is the Tuition Discount a Scholarship?

No. The tuition discount is awarded by St. Paul in response to the funded pledge to Georgia School Scholarship Organization. Other families (or yours) may apply for scholarships from the fund. Scholarships are granted by the school based on financial need and commitment to St. Paul. It is a simple way of building our scholarship capacity to support the needs of families in our community.

Tuition Discount Available

The Georgia Tax Credit Program allows families to build the St. Paul scholarship fund and receive a Georgia income tax credit in exchange for participating. To participate, visit GeorgiaSSO.com and submit your pledge today. When a school family participates, tuition will be discounted by $2500 per family in exchange for every $5000 funded pledge through the Georgia Tax Credit program (or 50% of funded pledge). Parents, other family members, or friends may participate and designate a St. Paul student for the tuition discount. GaSSO manages the school scholarship program for St. Paul.

Scholarship Fund

Support the St. Paul scholarship fund through the Georgia School Scholarship Fund (GaSSO). The St. Paul scholarship fund helps families in the future and as a thank you, participating families enjoy a significant discount for the 24-25 school year.

Are Scholarships Available?

Yes. Families may apply for a scholarship between February 1 and April 30 (or until funds are exhausted) for the coming school year.

What is the Maximum Amount Someone Can Donate Through GaSSO in Exchange for a Georgia Education Expense Tax Credit?

This is based on Tax filing status. New pledge amounts:

- Individual: $2,500

- Married Filing Jointly: $5,000

- Married Filing Separately: $2,500

- S-Corps/LLCs: $25,000

Is the Tuition Discount a Scholarship?

No. The tuition discount is awarded by St. Paul in response to the funded pledge to Georgia School Scholarship Organization. Other families (or yours) may apply for scholarships from the fund. Scholarships are granted by the school based on financial need and commitment to St. Paul according to eligibility qualifications listed below.

When is the Tuition Discount Effective?

Your tuition will be discounted for the 2023-2024 school year. The tuition discount will be applied as soon as the donation is registered with Georgia SSO.

When Should I Participate?

You should pledge right away and pledge the maximum amount allowed. You do not have to fund the entire pledge. Once the cap is reached for the pledge total, you will not be able to pledge support (a pledge must precede the donation).

What if a Friend or Family Member Participates?

Your family tuition may still be discounted if a friend or family member participates in GaSSO. You will need to notify the office with the name of the family member participating.

Who is Eligible for the Scholarships?

- Qualified to enroll in Pre K, Kindergarten, or first grade – automatically eligible

- Was enrolled in public school last year- automatically eligible

- If never attended public school, Second grade and up must attend a Georgia public school for at least six weeks

More details are available at georgiaSSO.com. To get started find the orange box that says “submit your pledge today!”